What is a Mortgage? The Shocking Origin of Home Loans

What Is A Mortgage?

The Shocking Origins of Home Loans

Let’s be honest, even in today’s modern times, getting an access to large amounts of money is not trivial. This is especially true for real estate and individuals or families that are looking to buy new property. Thanks to the many elements of our consumer society, it seems like everything is designed to make people make money, but then at the same time, spend it almost instantly. This includes small things like buying consumer goods, but also much bigger spending events, like the opportunities to invest in real estate.

Of course, this process has numerous advantages and is the solid foundation on which any capitalist society operates. Thanks to it, any society can develop and prosper, mainly because of the fact that monetary currents (aka. money) continues to move and cash continues to change hands. This allows people to have jobs, produce money and spend it, driving both the current economic state and its future growth. While the system continues to evolve, the needs for spending that pushes development further on is a constant fact. But, because of this, many people often find it difficult to save enough money for any kind of a big purchase, including getting a new house. Investing in real estate by its definition includes ample amounts of money that can be used to purchase a new property, which is something that many people just do not have.

This is the reason why people turn to the option of taking out a mortgage. Many times, this word brings about strong feelings, both good and bad, but in reality, people usually fail to fully understand the implication of a mortgage loan, starting from the very meaning of this word. In reality, any mortgage is a complex idea that can turn out to be either a blessing or a curse, all depending on the approach taken by those who venture in these types of loans. Here are some facts that might prove to be useful when dealing with a mortgage.

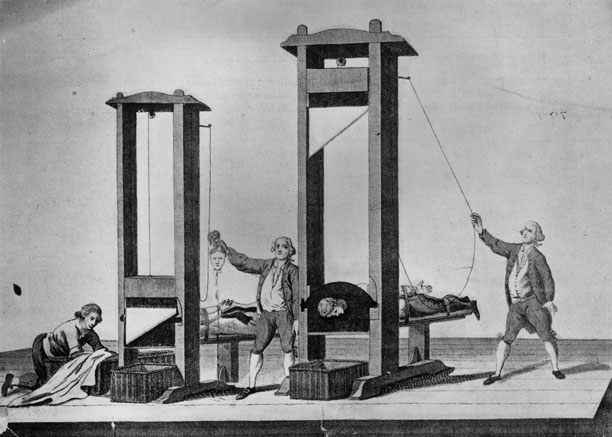

The Death Pledge

It is no wonder that people shudder at the very mention of the word “mortgage” because it is a combination of French words of “death” and “pledge”. As a death pledge, it was used in Medieval France, where peasants had to work until death for the option of having their own house. And the entire idea of a mortgage comes from the same period. According to history books, the first mortgage was encountered in England in 1190, when the Common English Law allowed for these kinds of borrowing systems and also took on this term from the French law.

In those times, loans were better known under the term “living pledges” which meant that a person pledges its possession for the duration of their life until their debt was paid off. Today, although the mortgage kept its grim meaning in simple language terms, the same option, available in any bank can offer truly life-changing possibilities.

The Idea Behind a Mortgage

A mortgage loan is utilized as a way in which a borrower raises money by securing a loan from a bank or any other financial institution by securing it with their property. If a borrower fails to return the borrowed amount of money or breaches the contract in some other way, the same financial institution can go for a foreclosure mechanism and take the same property into their possession. The idea of pledging a property for a loan is often horrific to many people, but the truth is that a mortgage is just another way of providing an injection of funds. The real question is how these funds are put to use, no matter if the borrower uses them to buy real estate or invest it in some other way.

Being Aware of Realistic Possibilities

Getting a mortgage is, in some way, the easier part of the process. The more demanding part is that in which the person decides what to do with these new funds. For example, a family might decide to buy a new home. With a large sum of money suddenly available, some feel empowered to drastically go beyond their normal abilities and buy a huge, expensive home. Although it might seem as if they can afford it at that moment, this approach is a sure way of becoming a slave to their mortgage’s monthly payments. Here, it is of paramount importance to make sure that any mortgage loan can be paid off in a reasonable manner. If this is not possible, the same family looking for a new home should consider a smaller or a more affordable dwelling. In this and every other case, the borrowers have to be aware of their possibilities and make a realistic plan of action.

Using (vs Abusing) Your Mortgage

The essential thing about mortgage is the fact that it should and must be perceived as a leverage instrument. With it, a business can be started or a house purchased. But it cannot be used as a way of accessing quick cash because this decision will then always come back and produce more harm than good. If a person desires a lifestyle they cannot afford, getting a mortgage is just a sure way of additionally degrading their current financial standing further down the road. Of course, this is not an easy task and good ideas are not just floating around.

Instead, hard work and effort needs to be invested in this process. As Robert Kiyosaki says, the winners in life are only those who always advance beyond their best. But, it is important to know that mortgage can be successfully utilized as an investment tool. For example, finding a house that produces a 10% interest and which can be acquired with a debt of a 5% is a great move that will generate money instead of using it up. These kinds of solutions are always present for those who are willing and able to use them to their advantage.

The Liberating Death Pledge

A mortgage might have a grim meaning from a purely linguistic point of view, but there is no doubt that will solid planning and wise investment; it can become a very liberating element in any life. Success stories that include mortgage loans can be seen in professional and personal lives, so their effectiveness is not debatable. With the right approach, all these benefits can be utilized by anyone willing to navigate the demanding, but bountiful waters of a mortgage.